Four Climate Solutions That Win Regardless of Who Wins in November

This blog is based on a Dine-Around at the MIE 2024 National Conference, where conference attendees gathered at restaurants around the Los Angeles area to dive deep into topics surrounding impact investing. For this Dine Around led by Heather Beatty, attendees discussed the Presidential Election’s impact on energy transition and climate investing. Below is an in-depth look at what was discussed. ScopeFour Capital’s full white paper on this topic can be viewed here.

Global election cycles can have important impacts on the climate investing landscape. Elections often lead to changes in policy, which can affect short to medium-term stock price performance in public equities. It is critical to look at political developments from both a risk and opportunity standpoint, as political uncertainty can negatively impact company valuations, but favorable policies can also provide a strong backdrop for outperformance.

Importantly, almost 40% of the global population (and 60% of global GDP) are holding elections in 2024. Thus far, we have been encouraged by recent outcomes in global elections, including the landslide Labour Party win in the United Kingdom on a pro-climate agenda, and the election of a former climate scientist as President of Mexico. We have now turned our attention to the U.S. election, particularly in light of significant new developments.

According to recent polls, the race is still a toss-up between former President Donald Trump and J.D. Vance versus current Vice President Kamala Harris and Tim Walz. The current consensus is that a binary outcome exists for climate equities: positive if Harris wins and negative if Trump wins. While the first scenario is certainly a bullish indicator for continued pro-climate policy and spending, a Trump victory may be more nuanced than what the market is assuming.

Since Q3 2023, climate equities have corrected for reasons mainly outside the political spectrum, i.e., macroeconomic concerns on inflation and interest rates. Going into this election season, valuations are attractive, and upside may be significant if Harris rides the coattails of a resurging U.S. economy to victory in November. If Trump wins, climate investors will have to be more selective in the short-term, but upside in the U.S. still has strong (albeit choppy) potential, supported by the long-term secular trend in scaling climate solutions.

Here are four climate solutions that offer strong investment opportunities regardless of the U.S. election outcome:

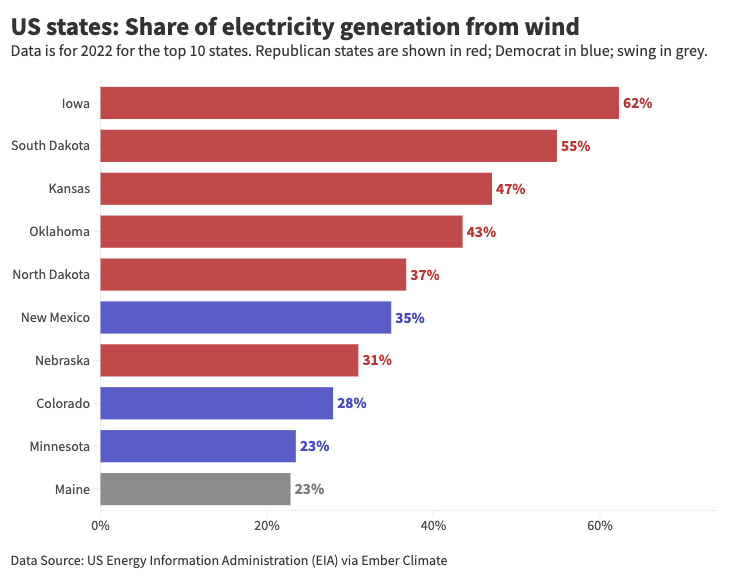

Onshore Wind: Trump’s first term was arguably wind-friendly; for example, an extension of the federal tax credit was signed for wind production in 2019. Red states are geographically located in the favorable wind belt, where average wind speeds are higher. This could mean a higher return on investment for those states and the multiplier effect of additional jobs, leading to continued policy support. Regardless, the anti-wind rhetoric on the campaign trail is likely to remain elevated leading up to the election.

Global election cycles can have important impacts on the climate investing landscape. Elections often lead to changes in policy, which can affect short to medium-term stock price performance in public equities. It is critical to look at political developments from both a risk and opportunity standpoint, as political uncertainty can negatively impact company valuations, but favorable policies can also provide a strong backdrop for outperformance.

Importantly, almost 40% of the global population (and 60% of global GDP) are holding elections in 2024. Thus far, we have been encouraged by recent outcomes in global elections, including the landslide Labour Party win in the United Kingdom on a pro-climate agenda, and the election of a former climate scientist as President of Mexico. We have now turned our attention to the U.S. election, particularly in light of significant new developments.

According to recent polls, the race is still a toss-up between former President Donald Trump and J.D. Vance versus current Vice President Kamala Harris and Tim Walz. The current consensus is that a binary outcome exists for climate equities: positive if Harris wins and negative if Trump wins. While the first scenario is certainly a bullish indicator for continued pro-climate policy and spending, a Trump victory may be more nuanced than what the market is assuming.

Since Q3 2023, climate equities have corrected for reasons mainly outside the political spectrum, i.e., macroeconomic concerns on inflation and interest rates. Going into this election season, valuations are attractive, and upside may be significant if Harris rides the coattails of a resurging U.S. economy to victory in November. If Trump wins, climate investors will have to be more selective in the short-term, but upside in the U.S. still has strong (albeit choppy) potential, supported by the long-term secular trend in scaling climate solutions.

Here are four climate solutions that offer strong investment opportunities regardless of the U.S. election outcome:

Onshore Wind: Trump’s first term was arguably wind-friendly; for example, an extension of the federal tax credit was signed for wind production in 2019. Red states are geographically located in the favorable wind belt, where average wind speeds are higher. This could mean a higher return on investment for those states and the multiplier effect of additional jobs, leading to continued policy support. Regardless, the anti-wind rhetoric on the campaign trail is likely to remain elevated leading up to the election.

Upgrading the Grid: The rapid implementation of Artificial Intelligence (AI)-related applications by large technology companies has significantly increased the expected amount of electricity required to power AI-focused data centers over the next few years. As a result, upgrading the global grid infrastructure to meet this demand will require a $21.4 trillion capex spend by 2050. Upgraded hardware such as new transmission lines, cables, and transformers, is needed along with new software to make the grid smarter, bidirectional, and more energy efficient. Modernizing the U.S. electric grid has long been a bipartisan issue, and we expect that to remain the case.

Green Hydrogen/Carbon Capture & Storage: These two segments may be the most protected. They have considerable backing from the fossil fuel industry, where Trump has expressed strong support in the past. Tax incentives are needed in these areas since they require large up-front capital investments to achieve scalability, and we anticipate current traction to continue picking up speed.

Nuclear Energy: Trump has been positive on nuclear energy, with a special focus on small modular reactors. There may be a renewed push to increase nuclear energy in the U.S., despite considerable bottlenecks including long lead times on construction, the Kazakhstan/Russia grip on uranium supply and enrichment, and public perception.

Conclusion: The Momentum is Already Underway

We have highlighted some segments that have the opportunity to prosper regardless of who wins the election. For example, we expect companies tied to upgrading the electric grid and onshore wind to benefit in the near-term, whereas we view companies tied to green hydrogen and nuclear energy as long-term investment opportunities.

Regardless of who wins, it is important to note the counter-balancing powers of the legislative and judicial branches of the U.S. government, as well as the power granted to individual states. For example, when the first Trump Administration tried to replace the Clean Power Plan (CPP) with the Affordable Clean Energy (ACE) Rule, many states and local governments sued the Administration and won.

The political environment is not the only variable that moves stock prices. The climate space has been hit hard over the past year due to worries on interest rates and inflation. This is where we see the opportunity. Although valuations are low, the majority of underlying companies that offer climate solutions are showing healthy earnings growth this year and have been consistently exceeding Wall Street expectations in recent earnings updates. If the political environment clears and policy initiatives become more favorable, low valuation multiples should also expand alongside this earnings growth.

Capital spending on climate solutions continues to rise, and the recent COP28 conference showed an increased global and corporate commitment to net zero initiatives. Therefore, while climate-oriented investors must be positioned accordingly for a binary election outcome near-term, we have high conviction that the tailwind of long-term secular growth in climate solutions is strong enough to withstand any single election.

Regardless of who wins, it is important to note the counter-balancing powers of the legislative and judicial branches of the U.S. government, as well as the power granted to individual states. For example, when the first Trump Administration tried to replace the Clean Power Plan (CPP) with the Affordable Clean Energy (ACE) Rule, many states and local governments sued the Administration and won.

The political environment is not the only variable that moves stock prices. The climate space has been hit hard over the past year due to worries on interest rates and inflation. This is where we see the opportunity. Although valuations are low, the majority of underlying companies that offer climate solutions are showing healthy earnings growth this year and have been consistently exceeding Wall Street expectations in recent earnings updates. If the political environment clears and policy initiatives become more favorable, low valuation multiples should also expand alongside this earnings growth.

Capital spending on climate solutions continues to rise, and the recent COP28 conference showed an increased global and corporate commitment to net zero initiatives. Therefore, while climate-oriented investors must be positioned accordingly for a binary election outcome near-term, we have high conviction that the tailwind of long-term secular growth in climate solutions is strong enough to withstand any single election.